December 2025

Kira Hinsley

Share

Leveraging Behavioural Science to Predict, Prevent, and Resolve Arrears

The introduction of behavioural insights to arrears management over a decade ago was a break-through for an age-old problem. The addition of a simple line indicating the social norm (“Most people pay their tax on time”) generated an extra £160 million in tax payments within just six-weeks (BIT, 2012). Ten years on, the fundamentals of applying behavioural science to collect arrears remain powerful, but the field has advanced significantly.

In this blog post, we showcase how behavioural insights, segmentation, predictive analytics and continuous experimentation are being combined to create adaptive arrears strategies that predict risk earlier, prevent arrears from forming, and resolve them more effectively when they do.

What are arrears and how are they collected?

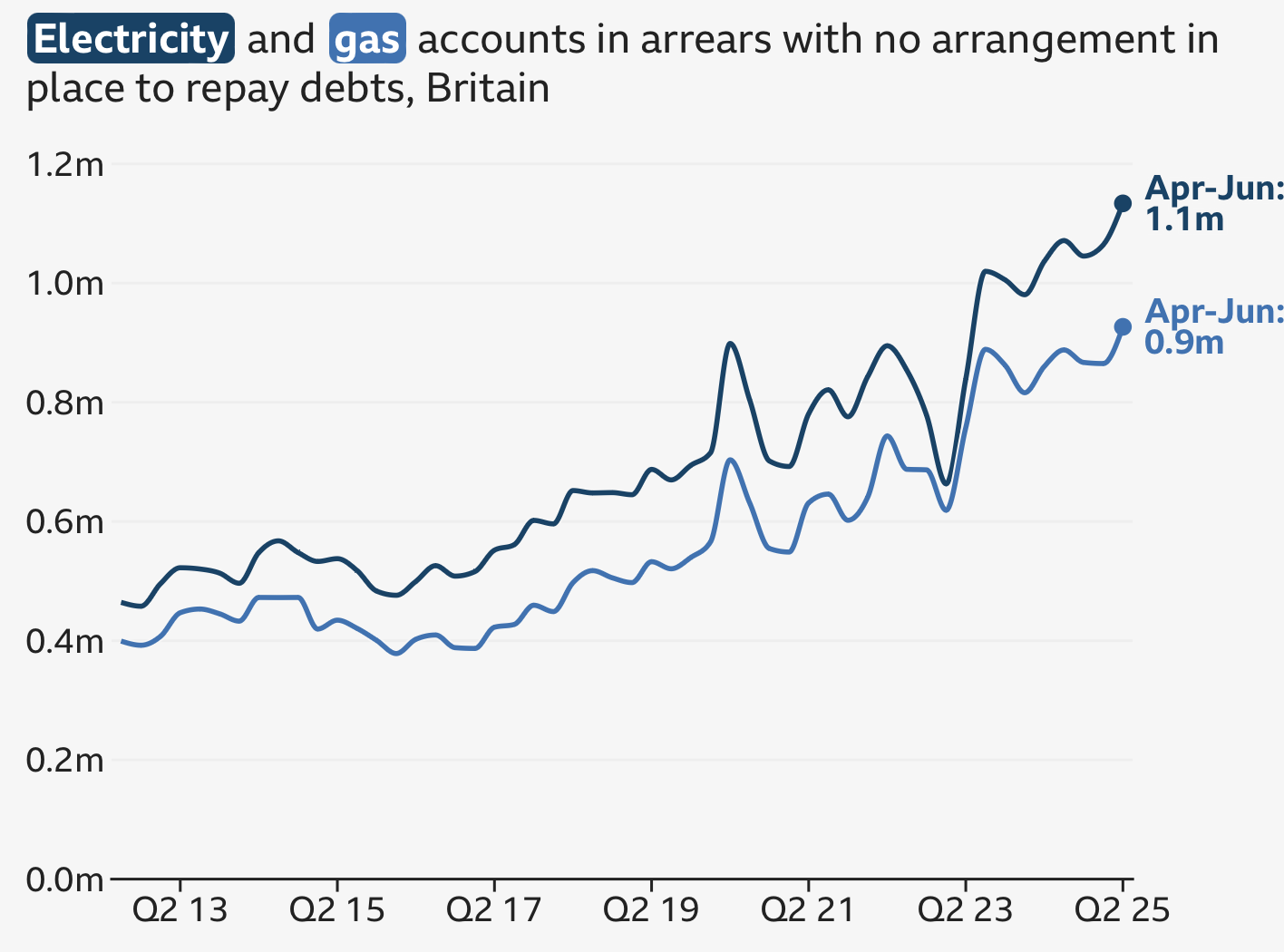

Arrears simply means owing money, and they occur across a wide range of sectors - from utilities and local government to financial services and telecoms. Arrears are increasing, with sectors such as energy and water reaching record highs this year (see Figure 1). Ofgem reports a record £4.4bn in energy debt, including more than one million households with no repayment arrangement in place. In the past, arrears collection relied on letters, repeated reminders, and eventually enforcement action.

Today, arrears management looks very different. Digital communication, richer customer data and specialist research have transformed the field, helping organisations move beyond standardised reminders to more personalised and proactive approaches. One of the biggest changes in arrears management is the shift from single-channel communication to multi-channel journeys.

Electricity and gas accounts in arrears with no repayment arrangement in place (Ofgem/BBC)

Using the right channels for the right purposes

Organisations can now reach customers through letters, email, SMS, app notifications and in-account messaging. Each channel has its own strengths, so adapting messages accordingly is important. SMS works well for short, urgent prompts, emails allow more detail, and letters convey formality and authority. Matching the tone, length and content to the channel boosts engagement and helps customers take timely action. However, effective communication also depends on knowing which customers need which messages, and that requires better data and smarter segmentation.

More data enables smarter segmentation and earlier prediction

Improved access to behavioural data allows organisations to understand why customers fall into arrears and tailor their approach accordingly. Two approaches prove particularly effective:

- Behavioural segmentation: People miss payments for different reasons. Segmenting them based on behavioural patterns, payment history and responsiveness allows organisations to align the level of intervention with the underlying cause, instead of relying on one-size-fits-all communications.

- Predictive analytics and early support: Analysing payment behaviour over time allows organisations to spot early signs of risk. Reaching out at these moments enables more supportive interventions, such as encouraging small initial payments, setting up direct debit, or seeking help before financial difficulties escalate into larger arrears.

Advances in behavioural insights

The core principles of behavioural science remain constant, but their application has become more nuanced and targeted. Four principles stand out as particularly effective in modern arrears management:

- Localised norms: Referencing the behaviour of people similar to the recipient (for example, neighbours or residents in the same area) increases credibility and impact. A line such as “9 out of 10 residents in your area have already paid” leverages social proof while applying it in a meaningful local context.

- Framing: How a choice is presented shapes how people respond. “Make a payment today to keep your account in good standing” (commission framing) emphasises the positive, while “If you don’t act now, your balance will increase by £X next month” (omission framing) highlights the cost of inaction. Presenting both helps people understand the full impact of their decisions.

- Anchoring: Providing a clear reference point, such as suggesting a manageable starting payment or indicating what others typically pay, helps guide decision-making. For example, “Most customers begin with a small payment of £15-20 to get back on track”. Anchors reduce uncertainty, which makes the next step feel easier and more feasible.

- Simplicity: Clear design and plain language makes action easier. Removing jargon, reducing unnecessary steps, offering direct payment links, and using subject lines that clearly convey purpose and urgency all reduce cognitive load and increase response rates.

Increased digitalisation enables more and better testing

Digital channels now make it possible to test, learn and optimise at scale, enabling continuous experimentation. By regularly testing and refining different message framings, timings, and channels through randomised controlled trials, organisations can build systems that improve performance over time, ensuring the system becomes more adaptive, personalised and effective.

Our work in practice

We’ve applied these principles across multiple real-world contexts:

- HMRC - We tested behaviourally framed tax reminder letters across two randomised controlled trials with over 200,000 taxpayers. Social norms and public-good messages outperformed the standard reminder, with a minority-norm line (“Nine out of ten people pay their tax on time”) generating an additional £2.4 million in 23 days. A second large-scale experiment replicated the results, delivering over £9 million in additional revenue.

- London Boroughs of Enfield and Haringey - We redesigned council repayment reminder communications using different framings to encourage residents to make arrears payments on time and to sign up to make recurring payments. Across two randomised controlled trials involving 30,500 households, payment compliance increased, with projected annual gains of £600,000. We also identified variability in response to different messages based on council tax band, enabling a more tailored outreach.

- San Antonio Water Systems - While focused on conservation rather than debt, this case demonstrates how the same behavioural principles apply across any context where organisations need to encourage timely action. To encourage water conservation, we designed behaviourally-informed communications incorporating social norms, pro-social rewards, and financial incentives. Tested in a randomised controlled trial of 23,000 residential homes, the interventions led to a 36% increase in lawn replacement uptake and a 1.4% reduction in water consumption.

A more supportive and effective arrears journey through behavioural science

A behavioural approach to arrears doesn’t need to be complex to be effective. In many cases, it starts with simple changes to communications, such as clearer subject lines, one localised norm sentence or a direct payment link instead of general instructions. At the same time, these principles can underpin a more comprehensive strategy that uses segmentation, predictive analytics and continuous testing. This means designing an arrears journey that optimally identifies what to communicate, when, to whom, how, and with what support options. The result is a more responsive, humane and effective approach to helping customers take action.

If you are interested in exploring how these approaches could work for your organisation, please don’t hesitate to get in touch!